The digital revolution in the financial services sector in Kenya has brought about the introduction on many innovative financial products and services built around the digital ecosystem that developed from the advent of mobile money transfer services in Kenya. The telecommunication service providers in Kenya; Airtel and Safaricom have partnered with other local and international tech based solutions providers to bring about increased competition that has consequently led to reduction in service and product prices to the benefit of the end consumer.

The result of such partnerships between the big Kenyan telcom company Airtel and financial service provider, Maisha Microfinance bank that is registered and regulated by the central bank of Kenya was the introduction of M-fanisi a mobile banking and Lending app. The partnership agreement signed in 2017 between Maisha Microfinance and Airtel saw the introduction of the M-fanisi service on the Airtel Platforms where users are able to directly assess saving and lending services from M-fanisi a product by Maisha bora Bank through their Airtel Lines by simply dialing * 334# and choosing the loans option number 7 and picking the option number 1, M- fanisi then proceeding to check their loan Limit and borrow.

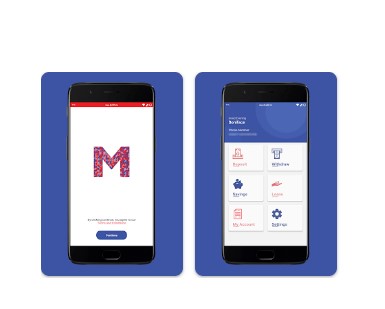

M-fanisi which is also available as a mobile app on google playstore offers a diverse range of service options including savings, fixed deposit, withdrawals, checking ministatements and micro loans to users. The convenience, accessibility and ease of use of the M-fanisi service through the USSD code or the App has made it popular with Kenyans as a micro-finance management tool and enabled many that were excluded from banking to find a solution that suits them in savings and accessing loans for personal use and small business.

For instance, if a user wants to obtain a personal loan for an urgent need, they can simply access Mfanisi event without internet connectivity through their airtel line through USSD code *334# or *222# and go to loans options and sign up for Mfanisi by picking option 7 and then option 1. After signing up in the simple registration through the phone, they can access the service and check their loan limit then process to borrow. The repayment of loans is also easy on the app as you follow the prompts using your Airtel line or through the App in case you don’t have your Airtel line with you.

The transaction and other fees involved vary according to the customers Airtel Money account usage and the customers loan repayment history and all fees are show during the loan application process. For one to increase their loan limit, M-fanisi encourages users to use their Airtel money and M-fanisi more regular for transactions and savings to build a better credit score.

The Mfanisi app is available for download for Android users on playstore Mfanisi here; https://play.google.com/store/apps/details?id=com.maishabank.mfanisi&hl=en&gl=US

The terms and services are also well outlined through the Mfanisi app that elaborates the terms and conditions in elan for users. The contact details for any challenges encountered with the service are also available on the app to ease the direct access and communication to customer service.